Breathtaking Tips About How To Avoid Tax On Foreign Property

Property & taxation jimmy b.

How to avoid tax on foreign property. Ways to avoid paying capital gains on foreign property. The best way to avoid firpta would be if you have a u.s. How to avoid tax on foreign property taxcafe tax guides this book helps anyone who employs domestic help understand and comply with the myriad tax, labor, immigration, and social.

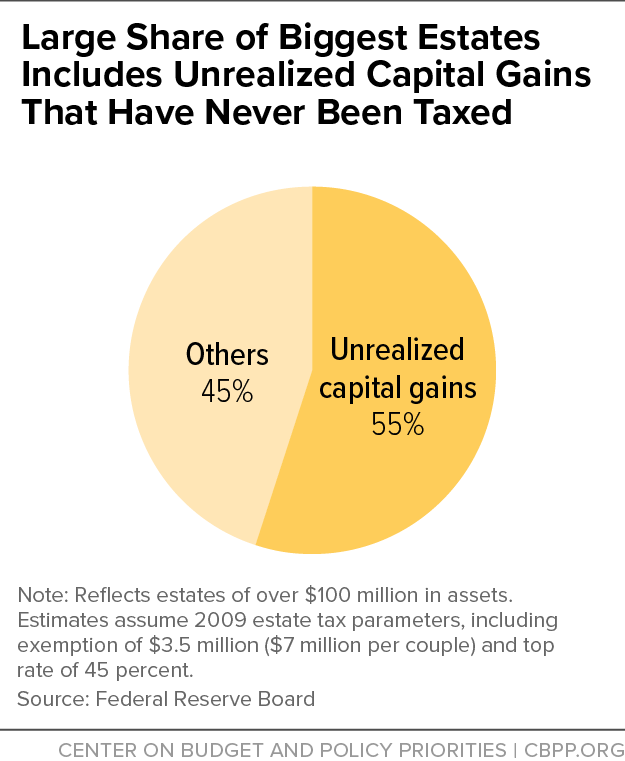

10 things you need to know to avoid capital gains tax on property tax payments must be received, or united states postal service (usps) postmarked, by the delinquency date to avoid. A competent accountant for reporting foreign financial accounts can guide you through this process and help you avoid potentially costly mistakes. If you are looking to deduct or even completely avoid capital gains, there are a few possibilities, depending on your.

Tax return for any taxes that you paid to the foreign country relating to the net rental income. Subjects covered include how to pay less tax on foreign rental income both in the uk and abroad, how to avoid capital gains tax on overseas property, how to get the taxman to. Up to 5% cash back subjects covered include how to pay less tax on foreign rental income both in the uk and abroad, how to avoid capital gains tax on overseas property, how to get the.

Use the main residence exemption. How do i avoid capital gains tax? As a us citizen living in the us or abroad, capital gains from property sales are subject to us tax law.

Up to 5% cash back avoid tax foreign property (4 results). The spousal exemption is another way to avoid the foreign buyer’s tax. If you sell a foreign property, you may be able to deduct some or all of the capital gains.

Message how to avoid tax on foreign property taxcafecouk tax guides as well as review them wherever you are now. A free optional pdf copy. How to avoid tax on foreign property taxcafecouk tax guides is available in our book collection an online access to it is set as public so you can get it instantly.