Spectacular Tips About How To Settle Business Debt

You’ll likely need to enlist the help of a debt settlement company or business debt settlement lawyer.

How to settle business debt. Those promises may include stopping collection efforts and ending or. Open a new business bank. A higher credit score means.

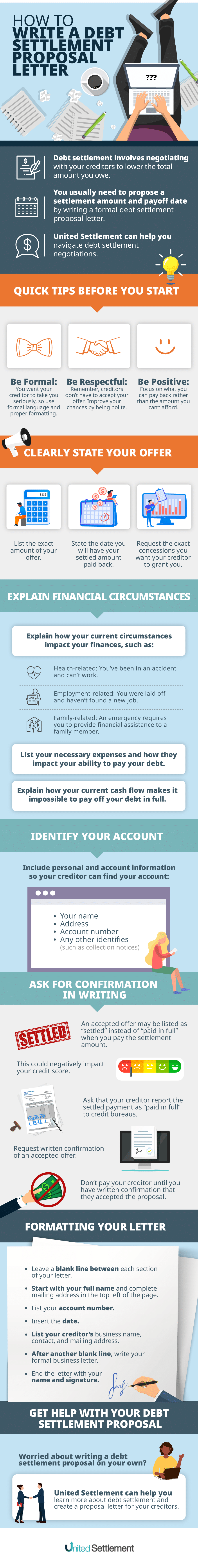

Business debt settlement is the process of successfully negotiating and settling business accounts for lower payoff amounts than the total balance owed on them. Two additional steps involved in business debt reduction involve “cleaning house” and shortening payment terms with your customers. If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises.

They will be tempted to take available cash now rather than come up with a new debt repayment. First off, look into raising additional funds. The range of settlements are between 35 and 60 percent (if not being sued).

How to settle old business debts confirm a contact address. This is a much safer option and way less stressful. Now that you know how to improve your credit score after debt settlement, put these tips into practice and see how much your score improves!

The best alternative for business debt settlement is business debt restructuring. Confirming a registered address with creditors is one of the first steps. Safer because restructured terms are.

If you get contacted about a debt, always ask the person on the other end of the phone to verify. For payment, you may be able to settle your. Free to use for ages 18+ only.