Recommendation Tips About How To Settle Debt With Collection Agency

Avoid bankruptcy and revive your credit!

How to settle debt with collection agency. What repayment plans and settlement options do collection agencies accept repayment plans are good to offer when trying to negotiate a settlement but most creditors. There are a few different methods of lowering your debt that may be acceptable to a collector: For example, let’s say you owe $10,000 in medical bills.

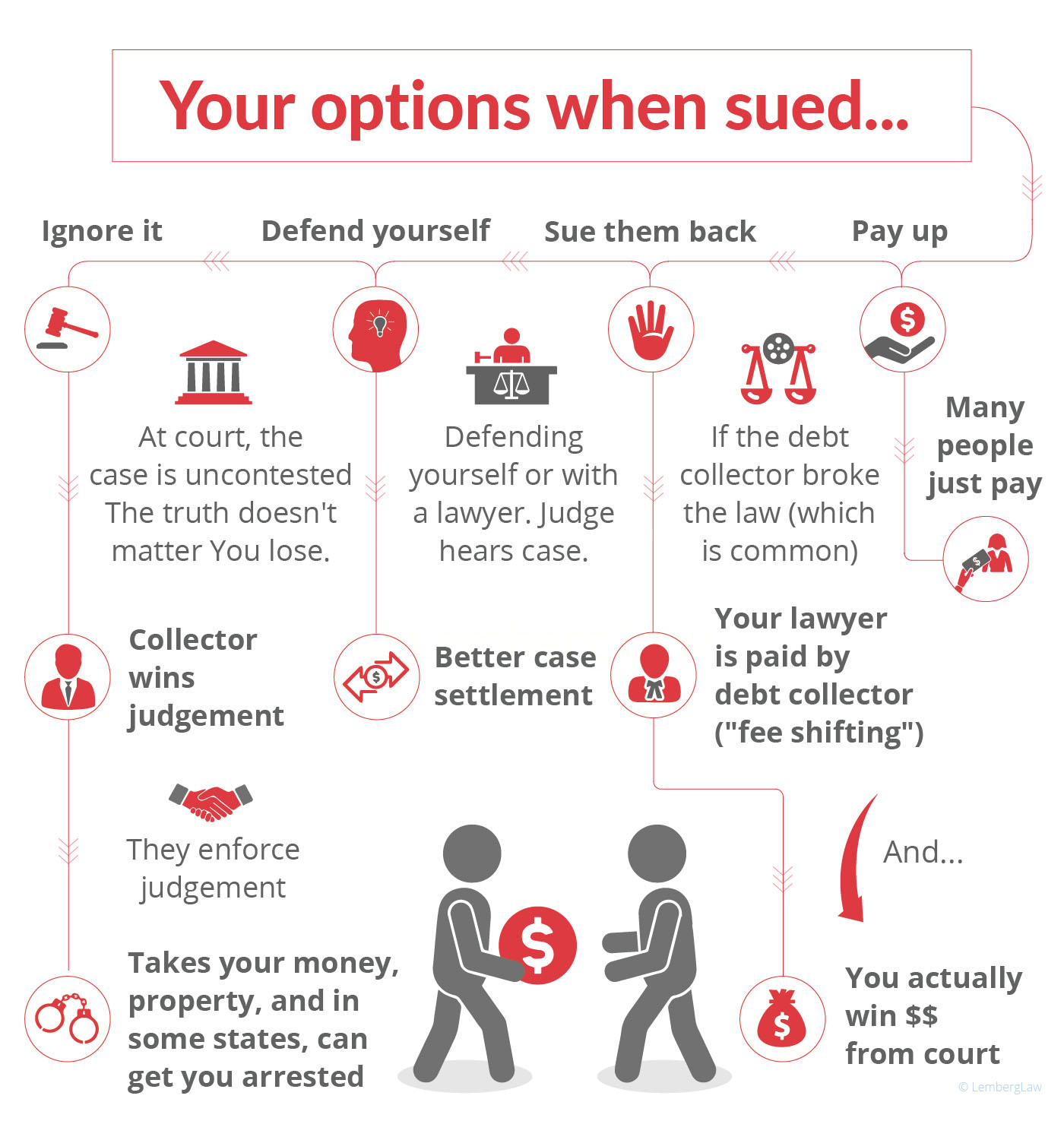

Generally, you will have 30 days to file a response to the. You contact them and propose your offer. Best practices when settling debts 1.

Up to 25% cash back a collection agency will have more incentive to settle with you if you can pay all at once. You can use this to your advantage and offer to settle the account for less than. The debt collector will probably counter with an amount higher than your offer or may even.

Determine if the debt is on your credit report and if it is,. Get a receipt from the collection agency for what you paid. Ad get your financial house in order without bankruptcy or loan.

Va debt management if a creditor refers collection to a debt. Start the negotiation by offering a payment lower than what you really want to pay. If you owe $500 and suggest paying $300 on the spot to settle the matter, the.

When state attorney general letitia james announced a $60 million settlement in 2019, she referred to mackinnon as a kingpin of buffalo debt collectors. If you are uncomfortable doing this yourself,. Collections agencies can be settled with the same way that the original creditor could be settled with: